A first in 7 years: ADAS costings show profit for free range egg producers

7th March 2023

Following a long period of recession, the figures are finally looking up for British free range egg producers, according to ADAS costings for March 2023, presented at this year’s BFREPA Roadshows. Farmers Guide staff writer Henrietta Szathmary attended the meeting in Wales on 2nd March to report on the discussion.

For nearly a decade, the British Free Range Egg Producers Association (BFREPA) has been hitting the road each year to meet members and get their feedback on some important projects that aim to improve egg prices and contracts available to producers.

This year’s Wales meeting, taking place in Llandrindod Wells on 2nd March, saw around 30 producers gathered to get the latest scoop on egg prices and contract agreements and offer their input to ADAS and BFREPA.

Following a brief welcome by the association’s vice-chairman Trevor Sellers, ADAS livestock consultant Fede Monte presented how monthly costings are calculated for the industry and invited members to offer their views on how the figures can be improved.

The BFREPA costings have been compiled independently by ADAS for the past nine years, originally for benchmarking purposes, and are updated every month. They are being used increasingly by the government, retailers and packers in monitoring the egg supply chain and developing improved egg supply agreements.

At present, the costings are based on the following financial indicators:

- A multi-tiered unit housing 32,000 birds

- Eggs per bird housed to 76 weeks: 335 (average), 348 (high-performing)

- Feed consumption gm/bird/day: 126

- Mortality rate: 8%

- Capital investment per bird: £42.00

- Producers capital investment: £1,344,000

- Annualised margin per bird: £1.13

- Year 1 – return on capital: 2.7%

Ms Monte explained that, to provide producers with a clearer picture of egg prices, the costings now also show the price/dozen eggs as well as the usual £/bird format. Moreover, certain costs that are more volatile, such as feed, pullet and electricity prices, are reviewed more frequently than others.

To account for the high variability in the industry, the costings show prices for both average and high-performing flocks (top 25%). While they might not feel representative to many producers, ADAS has been working hard to provide accurate figures for the industry as a whole. Taking more averages would mean retailers could choose the ones that are right for them when it comes to contracts, putting producers at a disadvantage, Ms Monte added.

With regards to capital investment per bird, the £42 figure is based on an existing establishment that was built 5-10 years ago, Ms Monte explained. She acknowledged that startup cost for a new entrant today would be around £2 million with £50/bird capital investment, and said ADAS is looking at creating a budget for new producers coming into the industry.

Highlights from March 2023 costings

Based on discussions with UK pullet rearers representing 70% of the industry, ADAS has calculated an average price of £5.24 for birds at 16 weeks of age. Ms Monte noted the price is low at the moment and is going to go up in over the coming months.

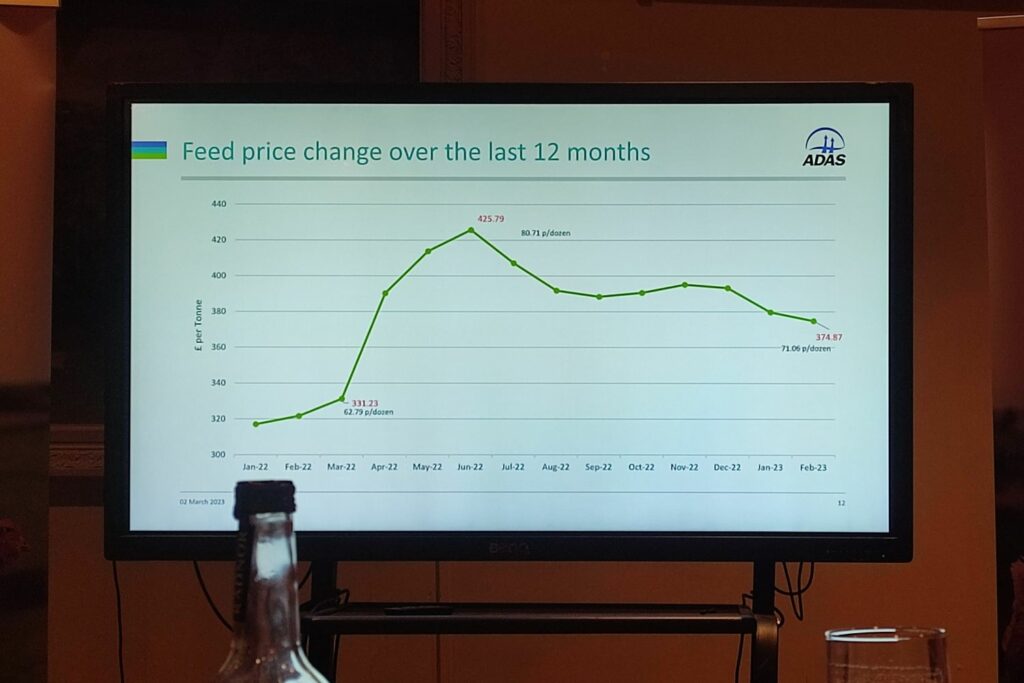

Meanwhile, feed prices stand at £369.73/tonne on the sheet, equivalent to £19.57/bird or 70.09p/doz in an average flock. In response to comments from the audience, Ms Monte clarified the prices are a mere snapshot of the time ADAS calculated them and not the real-time figures.

Bird feed price change over the last 12 months based on ADAS costings.

In terms of labour, the latest costs issued by ADAS are £2.77/bird or 9.93p/doz based on two full-time equivalent staff working 7 days a week, receiving just over national living wage. The calculations take into account holiday replacement (extra 11%), NI and pension contributions but not sick pay, Ms Monte said.

She added, that as with other costs, there is a lot of regional variation, and the figures will inevitably be too high or too low for some producers.

Meanwhile, electricity cost excluding renewables was calculated at £1.36/bird or 4.87p/doz based on a usage of 4KwH/bird. According to Ms Monte, the unit price of electricity has been extremely volatile in the last few months, but has stabilized somewhat recently.

From the remaining costs, she highlighted the price of insurance (£0.30/bird or 1.07p/doz) is not currently representative, as it doesn’t include coverage for avian flu (AI). She added future costings will include a separate line for AI and potentially salmonella insurance.

With all 20 cost items, total input costs for March 2023 came to £36.84/bird or 131.98p/doz when depreciation and interest were added in. Due to egg prices having gone up an additional 10p in the last month, ADAs has finally been able to show a profit for the first time in seven years, Ms Monte announced.

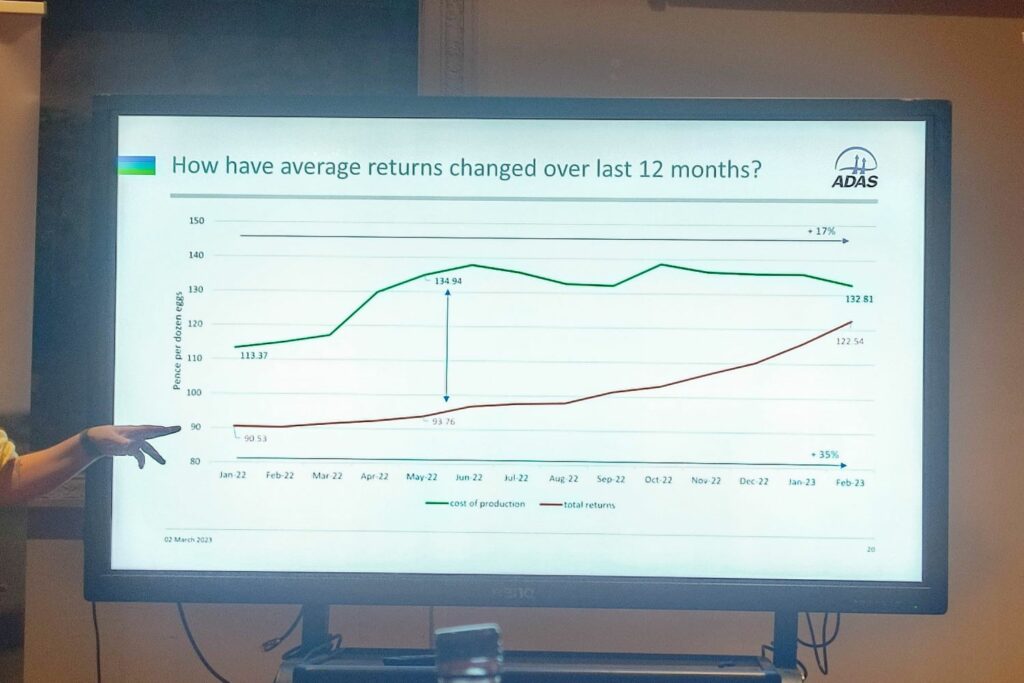

The graph below shows how the cost of production (green) and return (red) figures have changed over the last 12 months, up to February 2023. As of March, the figures have crossed over, showing a profit of £0.36/bird or 1.30p/doz.

Cost of production and return figures in the free range egg sector over the last 12 months. Credit ADAS

Ms Monte highlighted that input costs for free range egg producers have gone up 17% and returns 35% since January 2022, when the difference between costs and returns was around 22p/doz.

Moreover, the industry saw the highest losses to date (41.18p/doz) in May/June last year, when average input costs were at an unprecedented 134.94p/doz with returns as low as 93.76p/doz.

Part of the reason for the increase in egg prices, vice-chairman Trevor Sellers said, is BFREPA making the case for producers and pushing for higher prices throughout the past year. As a result, he concluded the industry is “not too far out on costings”, which shows promise for the future and will hopefully bring more new entrants into the sector.

Now is the time to negotiate for better contracts

Once the discussion on costings wrapped, BFREPA CEO Robert Gooch provided members with an update on Defra’s informal review of contracts in the egg supply chain and recent progress on improving producer contracts.

He also asked members to share their preferred types of egg supply agreements so BFREPA can make more of those contracts available to producers.

Mr Gooch stressed the importance of bedding ADAS costings into contracts, so packers and retailers are aware of where producers stand financially and a healthy margin can be agreed upon. Hence, it is vital that costings remain accurate and relevant to the industry so full credibility can be claimed, he added.

As part of their campaign for higher egg prices, BFREPA has been working closely with the farming and retailer press on making producers’ voices heard. Now that prices are going up, Mr Gooch said the aim is to lock them in to avoid a repeat of last summer.

“The question now is, how we get lock in using those costings as a basis for a sustainable, long-term future for free range egg producers and production,” he said.

According to the CEO, costings will be increasingly important in the transition to Cost of Production (COP) contracts in the future. These contracts are highly advantageous for producers, as contractors are required to pay for all of the allowed expenses in addition to a payment to enable profit.

Mr Gooch said the industry is seeing more and more COP-type contracts being offered and emphasized farmers should take advantage of the current shortages to negotiate for better contracts.

At the time of writing, contracts available to producers include:

- Variable price

- Fixed price

- Feed tracker

- COP tracker

- Bed & breakfast – only available from one packer so far

Elaborating on B&B contracts given they are quite new to the industry, Mr Gooch explained they reduce the risk to producers and include electricity, post clean down, audits, AI insurance as well as depletion and inflation. Meanwhile, items excluded from the agreement include litter, shed clean down, general insurance, biosecurity and chemicals, amongst others.

In addition, B&B contracts also have a bonus structure that rewards farmers for higher performance.

“One of the downsides is you can’t sell your own eggs at the farm gate, but you can buy them back at cost price from the packer and sell them at the gate once they’re fully packaged and ready to go,” Mr Gooch explained.

He also reminded members that contracts should be tailored to the risk profile and gearing of individual businesses. While the risk goes down when choosing contracts further down the list, these agreements might also bring lower returns, he added.

Once again, the CEO encouraged members to only sign contracts that suit their needs, as packers are currently desperate for supply and are keen to offer producers what they want.

“Please use this time to negotiate and push for what you want and don’t feel like you have to sign anything that you’re not completely happy with.”

While egg shortages are forecasted to last beyond the next 12 months, Mr Gooch cautioned that production will eventually go back up and urged members to choose contracts wisely.

“Although we’re making a profit now, there are a lot of sheds empty at the moment, and it’s likely eggs are going to be cheaper again next year,” he remarked.

With the poultry sector being in a constant cycle of ups and downs, it is ultimately the producer’s view of the future and risk tolerance that determines what type of contract they need, Mr Gooch pointed out.

Due to the volatility of prices, long-term variable price contracts are most likely to be susceptible to making losses for farmers. Whereas, fixed price contracts can guarantee a margin for the duration of the agreement, allowing producers to plan their business accordingly, he explained.

In his closing remarks, Mr Gooch established there is a crisis of confidence about contracts among free range egg producers, and BFREPA wants to make sure contracts are improved in the near future. He said retailers are more and more keen to realigning the supply chain and communicating more with producers about their needs.

A healthy margin is paramount for long-term sustainability

Members gathered at the BFREPA meeting in Llandrindod Wells agreed a healthy, stable margin is needed rather than ups and downs for free range egg production to be sustainable in the UK. Some called for an average egg price of at least £1.50/doz, others expressed the need for a margin as high as 25%.

One member also pointed out the UK has one of the lowest demands for eggs in Europe, with a figure of 199 eggs/person/year as opposed to the 230 average. Therefore, the question was raised, “How could free range eggs be better promoted to UK consumers?”

Addressing the question, Mr Gooch said BFREPA has been conducting a small campaign trying to promote eggs, however, it’s dwarfed by the campaign of the packers organisation BIC that has invested £2 million into the cause so far.

Concerns regarding cheap imports and products such as plant-based eggs flooding the market were also raised during the discussion. BFREPA vice-chairmen Trevor Sellers said retailers are currently importing Italian and Polish eggs, and there’s a real risk of British producers suffering further losses if those countries manage to eliminate avian flu first.

Finally, he urged members to prepare for a potential oversupply in the market and take steps to improve their production and business resilience in the time between.