What funding will be available to farmers from 2025 onwards?

30th September 2024

With farm funding uncertain from 2025, The Andersons Centre offers predictions on the ag budget and future prospects for each farming sector, as well as an update on ELMS.

The government has made it clear that it does not plan to make fundamental changes to ELMS, but how much funding will be available from 2025 has not been confirmed.

There have been rumours of a potential £100m cut to the agriculture budget, alongside calls to carry over unspent funding of £358m to future years.

In a recent webinar, Richard King, partner and head of business research at The Andersons Centre, offered expert insights.

Key issues for the industry include potential tax changes, particularly relating to inheritance tax, to be announced in the autumn budget on 30th October.

Meanwhile, amendments to the planning system could create opportunities for farmers, but also risks in terms of loss of productive land and compulsory land purchases.

However, the big question is what funding will be available for farmers going forward.

What do we know about plans for farm funding?

Currently the agriculture budget sits at £2.4bn in England which has been largely static since 2007, but with inflation rising by 60% in that time it equates to a real terms decrease.

It’s assumed that the autumn budget will set department spending for 2025/26.

Soon after, Defra is expected to provide the agriculture budget for the 2025 BPS year and BPS deductions for 2025 in England.

The Spending Review is due to conclude in spring and will shed light on plans for 2026-27 to 2028-29.

Whilst recent research by The Andersons Centre, commissioned by the NFU, found the ag budget needs to increase to £4bn, the prime minister has made much of the UK’s financial constraints.

Mr King predicts that the budget will remain static, or potentially rise a small amount, but not enough to reverse the real terms declines.

READ MORE: Labour Party Conference: What has Steve Reed said about the ag budget?

READ MORE: Govt urged to increase ag budget on Back British Farming Day

READ MORE: Government promises to restore stability for farmers as confidence among sector is low

ELMS update

New actions for the SFI and CS were announced in January but are still not generally available as a new portal is being tested.

Currently farmers can register their interest with the RPA but it’s not clear when the scheme will be open for all to apply, Mr King said.

There are now 102 SFI actions and it’s not known if more will be added for 2025.

But due to technical issues, it will no longer be possible to upgrade SFI agreements each year – in order to add new actions, farmers will need to start an additional agreement.

Meanwhile, a new application process for those whose Higher Tier CS schemes are coming to an end was promised later this year – but nothing has been announced.

The next round of Landscape Recovery was also delayed by the general election.

There is a question mark over what will happen to existing LR agreements, as they were designed to receive Defra money for two years before private finance stepped in, but it’s not clear that this finance is available.

Whilst the margin from ELMS will be lower than BPS, and it’s clearly more complicated to manage, Mr King said the total receipts can be good depending on the options chosen.

He also warned that if farmers do not take up the new schemes when they are offered the funds may soon move to other spending areas.

When considering whether to enter a scheme, he advised looking at it in the same way as any other enterprise – ask yourself, does it stack up?

Referring to concerns that large areas of productive farmland could be lost, he said the un-farmed area could increase slightly from an estimated 3-4%, to 7-9%.

Schemes in Scotland and Wales

In Wales, the Sustainable Farming Scheme has been delayed until 1st March 2026 amid a backlash over the requirement for 10% of land to be put into woodland.

The Habitat Wales Scheme is open for another year in 2025 and a Data Conformation Exercise (habitats) is underway.

In Scotland, ‘conditionality’ has been added to BPS for 2025 with a four-tier structure coming from 2026, though little detail is available.

The Less Favoured Areas Support Scheme (LFASS) will continue for at least three years, and the Ag Bill has been passed, with the Land Reform Bill due this autumn.

READ MORE: ‘Farmers Against Farmwashing’ uncovers harsh reality of British farms being on brink

READ MORE: Farmers encouraged to add value to their produce

What challenges are facing each farming sector?

Defra figures show a high of £8bn total income from farming in 2022 which has since come back down to the £6bn mark.

Going forward from 2024 onwards, Andersons is predicting this will continue, as inputs have declined somewhat, but outputs are also likely to be down especially in the cropping sector.

When it comes to return on capital, cereals, pigs and poultry and dairy farms on average produced a positive return, albeit at low levels, from 2009-10 to 2022-23. Grazing livestock farms did not.

Mr King stressed that the variation in performance within sectors is greater than that between sectors, so even in a bad year, it’s still possible to have good returns.

The variation from the bottom 5% to the top 5% is very large in each sector, and the pig sector has the largest range in performance.

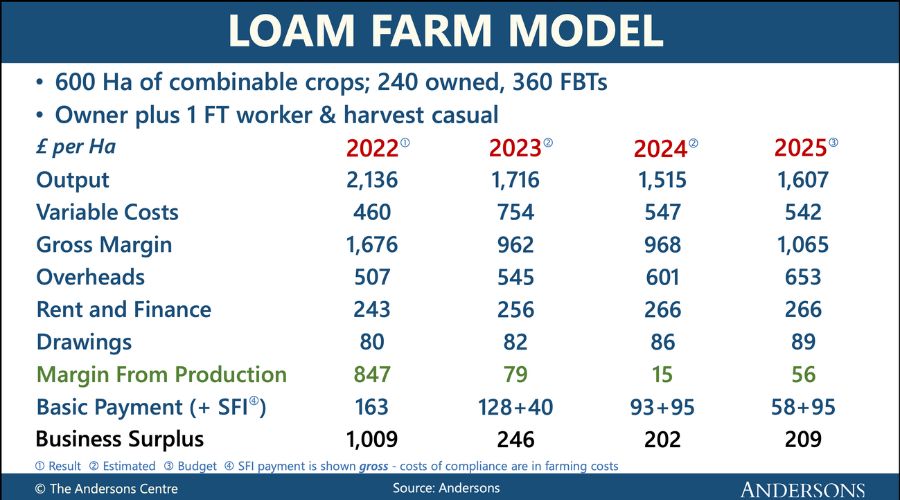

Combinable crops

Cropping conditions for 2024 were poor, at a time when prices and revenue through BPS are falling, but it’s been a hugely variable year, with some farms faring better whilst others may be in significant financial difficulty.

Weather volatility poses one of the most significant challenges outside of farmers’ control, and climate change may be making this worse – requiring more resilient businesses.

Productive land will also have to work harder as environment schemes are incorporated into less productive areas.

Accessing premium markets may be an option but crop storage will be key, coming with extra costs and possibly extra reinvestment. Labour and machinery costs also remain stubbornly high and keep rising.

Finally, carbon and biodiversity assessments will become increasingly important.

Dairy

Milk prices are on an upward trajectory, albeit quite slowly but a return to 50ppl looks unlikely, Mr King said.

Whilst variable costs have dropped from the peak they are still higher and overheads are continuing to creep up.

There are opportunities for the sector to reduce production costs, however, including maximising home grown forage, reducing fertiliser use and making the best use of slurries and manures.

Labour issues continue in terms of costs and availability, particularly as herd size grows and slurry storage is also a growing issue – as are environmental issues such as greenhouse gases and water/air quality etc.

However, good profits are being made and although the number of farms is reducing, litres of milk produced is rising.

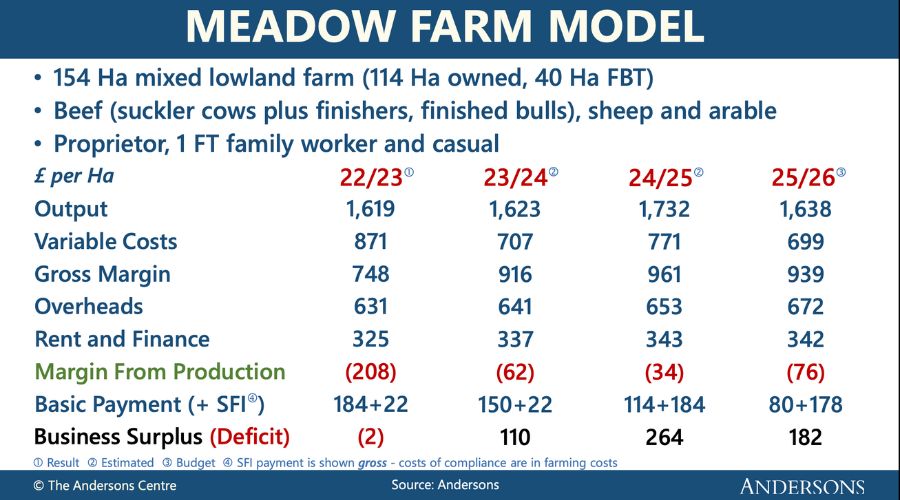

Beef & lamb

There has been a strong rise in beef values since 2021 and demand has remained strong despite the cost-of-living crisis, Mr King continued.

Although prices dipped a little in spring and early summer, they have risen again recently.

Record prices have been achieved in the sheep sector this year due to tight supplies and strong (export) demand.

Despite high prices in recent years, converting these into consistent profits remains a challenge, once the value of labour is factored in, however.

Other challenges include reduced support payments, greater competition from imports (e.g. trade deals with Australia and New Zealand) and increasingly urgent requirements to reduce carbon emissions.

However, prospects for the sector look reasonable going into 2025, maybe with some settling of prices, he concluded.

Read more business news.