What does the Budget really mean for farming?

11th November 2024

With much speculation about the recent Budget online, and significant anxiety among farmers, we take a detailed look at the implications of everything the chancellor said about farming.

Chancellor Rachel Reeves’s Autumn Budget has created significant fear and anger among much of the farming community.

Whilst the reduction in agricultural property relief on inheritance tax has dominated much of the discussion, there is also considerable concern about several other aspects of the Budget.

With speculation rife on social media, we take a look at everything the chancellor said about farming, separate the fact from the fiction, and share the advice from rural experts…

Inheritance tax

The headline news was the chancellor’s decision to reduce inheritance tax reliefs from April 2026, striking a huge blow to farmers’ confidence.

Agricultural and business property reliefs (APR and BPR) will be capped at £1m, with values above this only benefitting from 50% relief – effectively a 20% tax on assets over £1m, which can be paid over 10 years.

Tax relief on inherited pensions was also abolished, but this is subject to a consultation and changes aren’t expected to come into force until April 2027.

As the average net worth of farm businesses in England is £2.2m, AHDB calculates this would be liable to a £240,000 taxable charge on inheritance.

If this was borrowed, the total cost of credit would equate to an additional £81,000 (based on an interest value of 6.1%).

However, Defra says a farming couple will have a £1m allowance each, plus their standard tax-free allowances (£325,000 for nil-rate band + £175,000 for residence nil-rate band).

This would in theory bring the total allowance to £3m.

However, the allowance must be used on first death otherwise it may be lost – it is not transferable between spouses.

Additionally, the NRB is a personal allowance so may have been used for something else, and values over £2m will lose NRB entitlement.

READ MORE: Jeremy Clarkson will rally with other farmers on 19th November

READ MORE: “Stealth tax” on pickup trucks buried in Autumn Budget

How many farms will be affected?

The Treasury has claimed around 500 farms a year will be affected, meaning 73% of farms would not have to pay the tax.

This is based on HMRC figures from 2021-22 which showed there were 462 inherited farms valued above £1m that year.

However, many rural advisers estimate that only 50-acre holdings would fall within the £1m allowance, particularly when buildings and other assets such as machinery are factored in.

The Country Land and Business Association (CLA) has said the changes could impact 70,000 UK farms.

This figure relates to the total number of farms that could ever be affected.

Can farmers mitigate the impacts of IHT?

For farms who fall outside of the scope of the £1m allowance and cannot afford to pay the tax, they will have to decide whether to sell land or borrow to pay the tax.

For many, succession planning and valuation of assets will need to be carried out sooner than expected.

There has been much discussion on taking steps such as gifting, putting assets into trusts and other succession options before April 2026.

If assets are passed on more than seven years before death the tax could be avoided, but death after April 2026 and within seven years of a gift made on or after Budget day would be liable for the tax.

However, Carter Jonas head of rural Tim Jones noted that these are big decisions and “not something to be rushed into unless there are over-riding health or age concerns”.

He added: “Taking time to understand how the new tax regime is likely to affect succession is an obvious but important first step before considering the next steps.”

It’s also hoped that industry lobbying could result in the tax being reversed or amended, so some may wish to wait before making any big decisions.

Insurance may be another option and ranges from covering short term IHT liabilities relating to gifts etc or longer term policies to cover the full estate related bill.

But what suits one farm or state may not suit another.

“What is important is not letting the tax tail wag the dog,” Tim continued.

“Gifting, for example, might mitigate inheritance tax liability, but it has consequences too – for ensuring income or resources for future needs, the unforeseen early deaths in other generations, or marital difficulties for example.

READ MORE: “It’s a smokescreen”: Farmers’ reactions to the Budget

“It may also be worth considering partnerships to hold some assets, such as the farming equipment and stock.

“Taking professional advice which is tailored to your unique business structure and long-term objectives is key.”

One small silver lining was that the chancellor extended the existing scope of APR to include land subject to environmental schemes from 6th April 2025.

The positive impact of this will be reduced by the reduction in APR, however.

Wage increases and NI contributions

The minimum wage was increased to £12.21/hour from April 2025.

Additionally, employers’ National Insurance contributions have been raised by 13.8% to 15% and the threshold at which businesses must start paying was reduced from £9,100 to £5,000.

However the chancellor did extend the Employers Allowance, which employers can claim back from their NI bill, from £5,000 to £10,500.

Carter Jonas’s Tim Jones commented: “Farmers are going to have to look at technology, efficiencies, buying groups and possibly machinery/labour pooling.

“It remains to be seen whether the turmoil brought about by tax changes brings about more land to rent, which could offset these costs for some farming families/businesses.”

The ag budget

Defra announced the government’s £2.4bn farming budget will be maintained for 2025/26.

But David Eudall, AHDB economics & analysis director, noted that the funding pot for UK agriculture has remained constant throughout the 2019-24 parliament.

During this time, inflation has led to a 44% increase in farm costs.

There will, however, be a rollover of previously unspent funds from the ag budget.

Phasing out of old support schemes

While IHT dominated the headlines it was quietly announced that the government is accelerating the phase out of old support schemes.

Reductions are based on the payment received in 2020. For the first £30,000 received, there will be a reduction of 76%.

For any payments above £30,000, the money received above this level will be reduced by 100%.

For example:

If the amount received from direct payments in 2020 was £50,000:

- 76% reduction applied to the first £30,000 – a reduction of £22,800

- 100% reduction applied to the remaining £20,000

- Payments would be reduced to £7,200 for 2025.

Capital gains tax

Capital gains tax rose from 10% to 18% on the lower rate and from 20% to 24% on the higher rate from Budget day (30th October).

This brings the rates in line with those for residential property.

The tax is charged on profits made from selling assets including agricultural land and farms.

Carbon tax on imported fertiliser

The government confirmed plans to introduce a UK Carbon Border Adjustment Mechanism from 1st January 2027.

Aluminium, cement, fertiliser, hydrogen and steel products would be hit by the new tax, according to Treasury documents.

Double-cab pickups

Double-cab pickup trucks will be treated as cars for the purposes of capital allowances, benefits in kind and some deductions from business profits – from 1st April for corporation tax and 6th April for income tax.

For those who purchase DCPUs before April 2025, the existing capital allowances treatment will apply – so farmers thinking of investing are being advised to do so before this date.

Countryside Alliance predicts this will increase the BIK on a typical Nissan Navara Tekna, priced at £33,265 and emitting 167g/km of CO2, rise from £3,960 to £12,308.

Traditional benefit in kind arrangements will apply for employers who purchased, leased or ordered a DCPU before 6th April 2025.

They will be able to use the previous treatment until disposal, lease expiry, or 5th April 2029, depending on which comes first.

Farm Recovery Fund

In a Budget that contained very little good news, the government did say it would honour the £60 million Farming Recovery Fund to support those affected by Storm Henk and other severe weather last winter.

The Rural Payments Agency will contact eligible farmers directly.

Fuel duty

Fuel duty was frozen next year and the existing 5p cut will be maintained for another year too.

Draft alcohol

Reeves pledged to cut duty on draft alcohol by 1.7%, but non-draught drinks like wine and spirits will rise in line with the retail price index inflation.

Reach out for support

The overriding message from rural advisers and farming organisations is to seek advice from professionals, as what works for one business may not work for another.

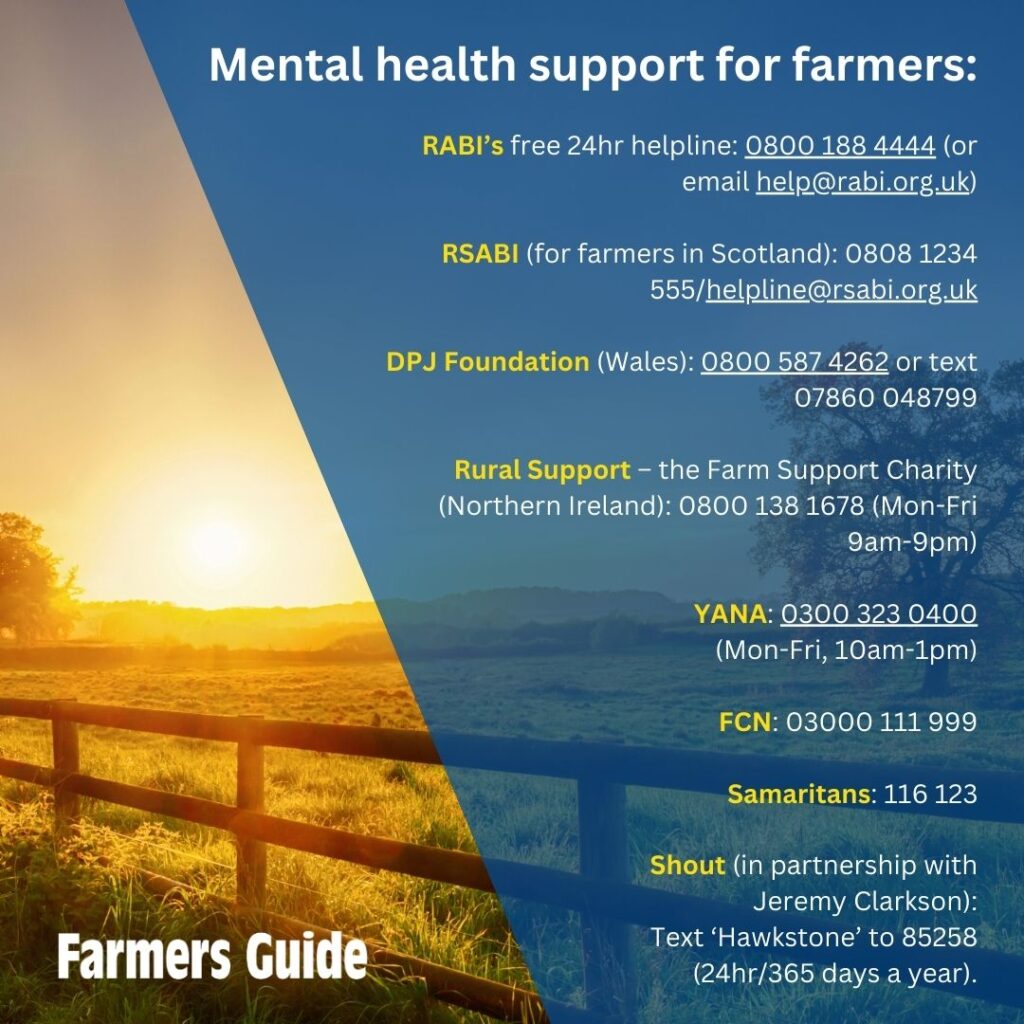

The Budget announcement has caused significant worry among farmers – if you’re struggling, there are a number of organisations to reach out to for support:

Read more business news.