Labour MPs vote against bid to scrap family farm tax

6th December 2024

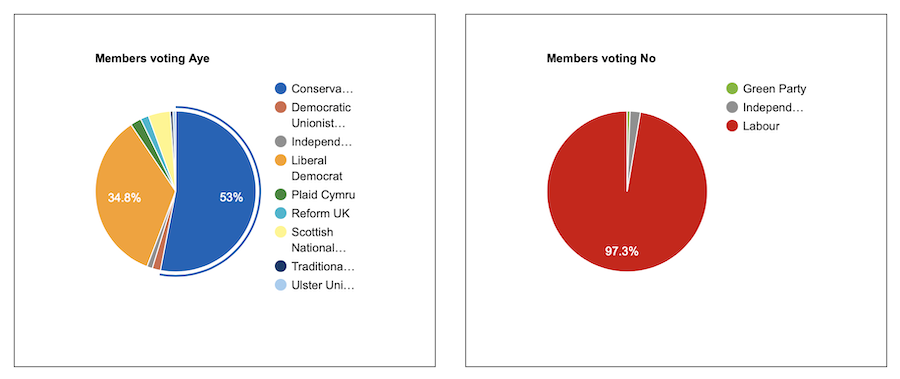

A non-binding Conservative motion against the family farm tax has been voted down by 339 votes to 181.

MPs urged the Labour government to back down on its inheritance tax plans during a debate in parliament this week, which saw 330 Labour MPs vote against the motion.

However, one Labour MP Markus Campbell-Savours noted that had it been “the real vote” he would have voted against the government’s plans.

“I am no rebel – I am a moderate – but during the election, I read what I thought were assurances from my party that we had no plans to introduce changes to APR.

“On that basis, I reassured farmers in my constituency that we would not, and now I simply am not prepared to break my word,” he said.

“Punishing” British farmers

Conservative MP Victoria Atkins accused the government of providing conflicting information on the number of farms affected – and failing to carry out an impact assessment of the new approach.

Figures from the NFU suggest three quarters of farms will be affected by the reduction of agricultural property relief.

An average arable farm, meanwhile, would have to sell 20% of its land to pay the IHT bill, according to CLA.

Hundreds of Labour MPs (330) voted against the motion to scrap the family farm tax, along with seven independents and two Green Party MPs.

Meanwhile 96 Conservatives voted in favour, along with MPs from a number of other parties, including Liberal Democrats (63), Reform UK (3) and SNP (8).

Commenting on the result, one of the organisers of the London farmers’ rally on 19th November, Martin Williams, said:

“The result was not a surprise; no Labour MP was going to vote against a financial bill its party put forward. It was encouraging to find voices calling for modification and on that we should concentrate.”

The organisers of the rally are set to host a new event at the London Palladium on 16th December – which will welcome a wide range of businesses impacted by the Autumn Budget, including farmers and ancillary businesses.

IHT plans broadly criticised

During the debate, cross-party MPs raised a range of objections to the plans to reduce agricultural property relief to 50% on farms worth over £1m.

Many warned that hard-working family farms will be hit, rather than large landowners using a loophole to avoid tax, and there were concerns about the mental health toll on farmers.

MPs also warned that when the land is sold, it will likely go to foreign investors and hedge fund managers, not farmers.

Additionally, it was pointed out that many farmers do not have a pension and therefore plan to work well into old age – meaning they cannot gift the farm to the next generation to avoid IHT.

There are also concerns about the impact on the wider rural economy if farmers are investing less in their businesses.

READ MORE: Inheritance tax poll: Labour is losing the countryside

READ MORE: Organisers of last month’s rally invite farmers to London on 16th December

Mrs Atkins said the new approach to IHT has “driven farmers to despair”.

She also hit back at the government for forgetting to include business property relief-only claims in its figures.

This means that as many as 14,000 tenant farmers who cannot claim APR are absent from their calculations – and ministers do not know how many farmers are affected by this, she said.

Farmers who transferred their farms into companies or partnerships, who only claim BPR, were also left out.

Meanwhile, the claim that farmers will be able to transfer £3m tax free is “wrong” and does not apply to widowers, single people and those who own a farm with another relative, she noted.

A number of MPs pointed out that the tax raid is expected to raise £500m from 2026-27 – hardly a game-changer in filling the £22m black hole in public spending.

Lacking profitability

Labour MPs hit back at critics by claiming that farming suffered for 14 years under the Tories – and that the lack of profitability in farming is the real issue.

Lib Dem MP Tim Farron said one hill farmer he spoke to had lost £40,000 a year in basic payments, to gain just £14,000 from the SFI. And he had to pay £6,000 to go through a land agent to get it.

He noted that even prior to Labour’s election “the farming economy was under enormous threat and in enormous danger, either by accident or design, due to the failures of the previous Government, and the Conservatives need to take that on the chin.”

READ MORE: Government cancels farming scheme and cuts spending on British food campaigns

READ MORE: Farmers’ tractor protest set to take place in four capitals on 11th December

However, he accused the Labour government of missing a “massive open goal” to get farmers on-side, given what it inherited from the Tories.

MPs suggested granting an IHT exemption for working farms, and landowners who grant leases in excess of 10 years, which would protect tenant farmers.

Defra secretary absent

Secretary of state Steve Reed was not present at the debate but James Murray, exchequer secretary to the Treasury, spoke in defence of the tax.

He repeated the government’s argument that the tax raid is a “difficult but necessary” move to help fill the £22bn black hole in public finances from the previous administration.

MPs pushed back on Mr Murray’s argument that APR has only been available since the 80s, by pointing out that the relief was introduced to help families pass farms to the next generation amid rising land prices.

Labour was also criticised for failing to see farmers – who work long hours in tough environments, often into their old age – as working people.

Farming minister Daniel Zeichner concluded the debate by reiterating the government’s assertion that 500 estates a year will be affected, based on claims data.

He said the changes will “disincentivise the wealthy from buying up agricultural land to shield their wealth from inheritance tax, and they will also raise the money needed to fix those public services”.

He added that there is “plenty of time for people to plan for change”.

Additionally, he said the government would continue to engage with the NFU, the CLA, the Tenant Farmers Association and other stakeholders.

Mr Zeichner also hit out at the Conservative government, claiming the protests were “not just about APR” and the Tories had “sold out” British farmers in trade deals with New Zealand and Australia.

Read more political news.