Iceland boss and Labour supporter opposes family farm tax

4th February 2025

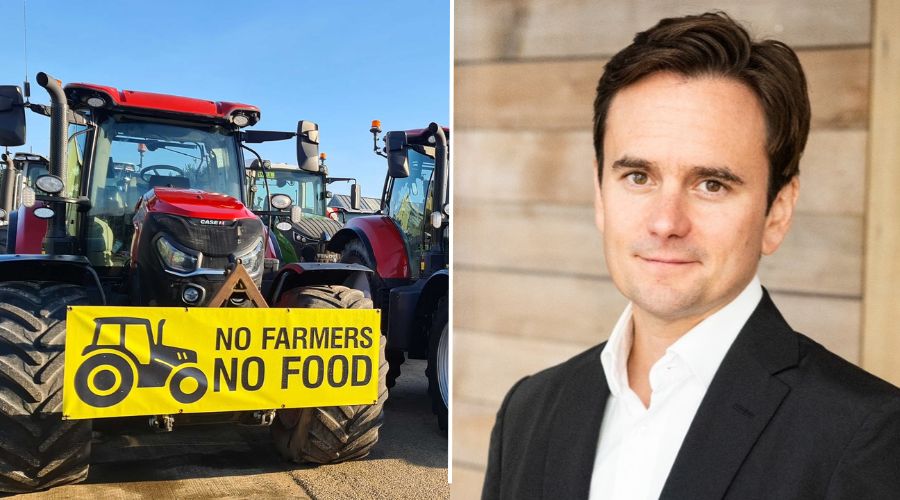

Richard Walker, the managing director of Iceland and Labour Party supporter, has spoken out against Rachel Reeves’s inheritance tax raid on farmers, breaking with the party after previously supporting its Budget.

Mr Walker criticised the chancellor’s decision to target farmers with higher death duties, suggesting that online retailers would be a better source of tax generation for the Treasury.

He told The Telegraph: “The Treasury is right to look at levelling the playing field on tax, but it has parked its tractor in the wrong place going after hard-working British farmers.

“Let’s stop messing around and make online sales tax reform the priority. High streets and farmers are the bedrock of this great country, we need to get behind them.”

His comments came just hours after he was criticised for failing to publicly support farmers in the tax row despite concerns raised by almost every other major supermarket.

‘Time to speak up is now’

Countryside Alliance said that the comment made by Mr Walker can be seen as a major break with Labour after he spoke out in support of Rachel Reeves numerous times over recent months.

In December, he urged business chiefs to stop “wallowing” and “complaining” about higher taxes.

Last week, the campaign group No Farmers, No Food had called on Mr Walker to support the industry, while the Countryside Alliance urged all supermarkets to take a stand “before it’s too late”.

No Farmers, No Food posted on X: ‘It’s heartening to see the majority of major supermarkets supporting farmers in their campaign against the government’s inheritance tax on family farms.

‘But why haven’t Iceland Foods done the same? It’s time for all our major supermarkets to unite for farmers.’

Mo Metcalf-Fisher, external affairs at the Countryside Alliance, added: “We welcome this intervention from Richard Walker and thank supermarkets across the board for taking a stand. The time to speak up is now, before it’s too late.

“As the distressing ramifications of the proposed inheritance tax changes to family farms become clearer, more and more businesses are rightly opting to stand with farmers in a common-sense call to the Treasury for an urgent policy rethink.

“Major brands in the wider food and hospitality industry should be thinking about their supply chains and their long-term ability to meet the growing consumer demand for food and drink produced in this country. This won’t happen if we lose family farms and further rely on imports.”

READ MORE: Farmers invited to join Westminster tractor rally next month

Retailers back British farmers

Retailers including Tesco, Waitrose, Marks & Spencer, Co-op, Sainsbury’s, Asda and Morrisons have all spoken out against the chancellor’s IHT changes in recent weeks, demanding she rethink the overhaul.

Ashwin Prasad, Tesco’s chief commercial officer, said that the planned raid on farmers would put Britain’s food security at risk.

The National Farmers’ Union has argued that 75% of farm businesses could be impacted, with other industry estimates suggesting 2,500 farmers a year will be hit by the overhaul, five times as many as official forecasts. The Treasury argues only 500 estates a year will pay more under the new scheme than they do today.

A major demonstration in opposition to the proposed changes is due to be held in Westminster next Monday, 10th February, to coincide with a parliamentary debate on the viral petition ‘Don’t change inheritance tax relief for working farms’ after it passed the 100,000 signatory threshold on Parliament’s website.

READ MORE: Tesco, Co-op and Lidl back farmers in ongoing inheritance tax row

READ MORE: More supermarkets stand on farmers’ side in IHT fight

Read more political news.