Grower studies indicate stabilising winter OSR area

26th June 2017

After five years of decline, the national winter oilseed rape area is set to stabilise this autumn at just over 550,000ha, according to the latest annual winter OSR Planting Intentions

After five years of decline, the national winter oilseed rape area is set to stabilise this autumn at just over 550,000ha, according to the latest annual winter OSR Planting Intentions Study conducted by Independent Business Resource Ltd in conjunction with Kleffmann Group.

Undertaken with a sample of over 200 growers across Great Britain carefully structured to be representative of national cropping, the May 2017 study indicates that the majority of farmers are planning to plant a similar amount of OSR to last autumn. Just over 20% intend to reduce their area of the crop this season, but this is almost exactly balanced by those intending to increase plantings.

The net result is a predicted year-on-year decline in the national winter OSR area of well under 1% compared with the average annual reduction of well over 4% seen from 2012, although this will clearly depend on the performance of the current crop and conditions around planting.

“We’re definitely seeing a stabilisation of winter OSR growing,” commented study organiser, Roger Pratchett of IBR-Ltd UK. “There is, of course, plenty of scope for change before planting time. But sensitivity analysis of our data indicates as least as much, if not more, upside than downside potential.”

Regardless of their planting intentions, the latest study shows the overwhelming driver for the amount of oilseed rape growers plan to drill this autumn is their rotational schedule. Overall, indeed, this is more than 15 times as important as the biggest agronomic threat driving current OSR planting decisions – flea beetle – underlining the degree of certainty around the figures.

“This latest market intelligence parallels the findings of our more detailed study of winter OSR attitudes and intentions involving nearly 250 growers from 46 UK counties this season,” commented Dekalb marketing manager, Deryn Gilbey.

“Only a very small minority of growers intend to give up OSR growing altogether. Not surprisingly, these are concentrated in the central and eastern counties which suffered particularly badly from last autumn’s lack of moisture as well as flea beetle.

“More than this, though, our study shows these parts of the country achieved average yields of just 3.32t/ha over the past three seasons compared to 3.8 t/ha or more for most of the rest of the country.”

Under these circumstances, the Dekalb study shows a proportion of growers – again mainly in these areas – are planning to reduce their plantings to extend rape to an average of once in every 4-5 years in their rotations. In contrast, noticeably more of those in the north and west of the country are looking to maintain or increase their winter OSR growing.

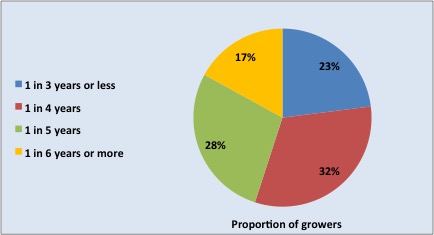

Interestingly too, the number of growers still planning relatively tight OSR rotations exceeds the number looking to rather longer rotations, and these are by no means all confined to western and northern areas (Figure 1).

Figure 1: Planned OSR Rotational Frequency

Source: National Winter OSR Attitudes & Intentions Study 2017

The stabilisation of OSR growing suggested by both these studies is, perhaps, to be expected given the relatively good current market prospects for UK rapeseed, with continuing strong European demand for both rapeseed oil and meal.

Because Europe remains far from self-sufficient in vegetable oil production, oilseed rape is also less vulnerable to world market fluctuations than feed grains. Equally, it offers valuable opportunities to replace imports of palm oil with healthier and more environmentally-sound home production.

“Of course, changes in the value of sterling will be important in determining future UK prices,” noted Deryn Gilbey. “But these will impact commodity markets to the same extent, so will have little or no effect on the relative position of rapeseed against alternative crops.

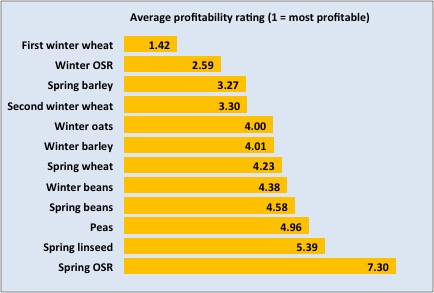

“In this context, our study confirms that winter oilseed rape remains second only in profitability to first wheat for UK growers, maintaining its clear advantage over all alternative cereal breaks (Figure 2).

Figure 2: Relative Crop Profitability

Source: National Winter OSR Attitudes & Intentions Study 2017

“Understandably then, winter OSR seems set to remain popular wherever it can be grown with sufficient reliability,” he concluded.

“With their clear performance advantages, growers in the west and north look better placed than most to take advantage of opportunities in the UK market resulting from issues with the crop in other parts of the country. Particularly so with the even more resilient, yield-protected varieties coming from our leading European breeding programme and the clear whole farm management advantages growers consider OSR has over most alternative cereal breaks.”