What happens if weather extremes are the new normal?

21st October 2024

Cecilia Pryce explores the future impacts of extreme weather, while Lucy Hassall offers an update on volatile fertiliser markets.

Another year and another set of weather records broken, but what will the lasting effects be? So asks Cecilia Pryce, head of research, compliance & shipping at Openfield.

Extremes of weather seem to be the new norm, and unfortunately something we are all having to learn to live with – but what is the long-term impact on farmed area? We recently saw the data published for the agricultural land use in England at 1st June. Nothing too amazing about that, but if you project the data across the whole of the UK it would show around 10.5% of the total cropped area in 2024 was not growing crops.

To put that into perspective, it was around 6% for harvest 2020 and averaged 4.66% for 2021/22 and 2023. In other words, around 642,000 hectares of arable land is either fallow or in SFI schemes, or in wheat tonnes around 5 million tonnes of missing grain.

It’s not an easy record to stomach but the point is, moving forward, does it decrease or just get higher? Do we see a return to a more normal arable season, or if weather extremes are here to stay is this the new normal? More importantly is the land that is being pulled out really poor-quality arable land? Can the land that is left produce more grain?

The latest headline from the EU was reporting the smallest wheat crop since 2012, but the 2012 crop was produced from a much bigger area but an even worse yield. Have varieties and growing systems changed that much over 12 years? The fact is that variables can change but how much risk and money are governments prepared to put on the table for environment over food and feed? Only time will tell but if we grow daisies, we really need to be able to put a real terms value on them and also try our best to understand the issues that weather extremes are generating when looking to feed the nation.

On a similar point, with such a wet autumn in the EU, the maize crops are reported to now be suffering from very high levels of mycotoxins. The reality is legislation has set limits and if those are exceeded then there is little that can be done with crops – you shouldn’t knowingly blend toxins or contaminants. Unfortunately, it’s yet another reminder of the importance of sprays and timely inputs – assuming there are any and there’s an opportunity to use them.

Legislation is there to protect us all, but with extremes of weather and changes to cropping methods comes consequences and the next decision will be – do governments grant a derogation on toxin levels in maize, or is the grain destined for a no feed/food use i.e. burning? You can’t consume it if it produces a by-product, because that also runs the risk of it not being fit for purpose. Food and feed waste concerns will then be raised and a further decrease in the availability of supply. Life is never easy but please keep the faith. The world needs farmers and food but I feel we will only really realise this when it may be too late for a quick policy change.

Finally this month, may I ask you to please check on your stored crops. I mention this as water ingress under doors and down walls is a common issue and crops that are not monitored have a habit of springing surprises on many when out loaded, and we don’t need UK issues with storage moulds alongside ergot and low proteins. Also don’t forget short term stores need emptying before the end of October.

Fertiliser matters

As tensions continue to escalate in the Middle East, we are once again facing volatile fertiliser markets as a result, explains Openfield fertiliser manager Lucy Hassall.

At the beginning of September, India announced a tender for significant tonnes of urea for October shipment which resulted in a small spike in pricing. There has since been another tender announced at the end of September for November shipment, again causing the market to firm. During this month Egyptian producers had also faced short term gas cuts resulting in production shutdowns and adding to pricing pressure.

Despite a quiet fertiliser market over harvest there has been no reductions in AN pricing due to the continuation of high energy costs across Europe. Producers are more inclined to turn down production rates than build stock at high input costs to sell at some point in the future.

Blenders have also been cautious about bringing in new vessels of product during this quiet time, meaning the UK isn’t sat on large stocks of product. With this in mind, it would be advisable to purchase at least part of your requirements in order to help manage risk.

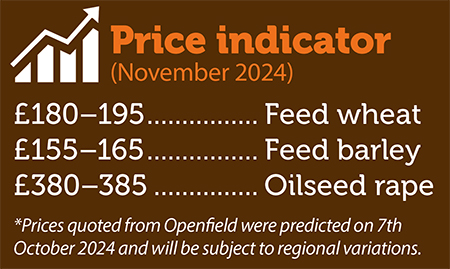

Visit the Openfield website for more information

Read more arable news