Does the UK have a plan for farming?

19th November 2024

With few policy makers having spent time at the coal face of farming, what is the future of UK agriculture?

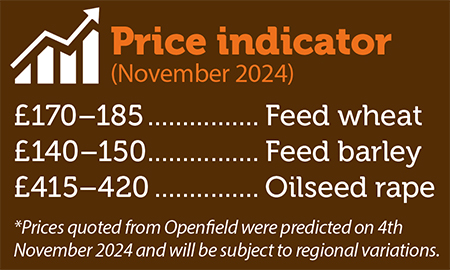

Does the UK, or should that be the devolved nations of the UK have current agricultural policies? So asks Cecilia Pryce, Openfield’s head of research, compliance & shipping.

As a student in the late 1980s we spent many hours debating EU agricultural policy and watching as the rest of the world ‘opened up’ and set forth on their agricultural policy journeys. Similarly, throughout my trading career I spent hours wading through policy and legislation to try and identify what may or may not happen next in different countries.

In the 90s we had rules for everything, be that how to put commodities into intervention stores or how to take them out, or even how to get a rebate for the deference between internal EU grain prices and world prices – it was another world.

The company I worked for moved many tonnes of barley out of northern intervention stores to exciting third country destinations, which at the time was a huge logistical effort. We had rules to play by and a clear forward plan, but since Brexit I have seriously started to worry about what happens next to UK agriculture.

I feel that the ‘National Food Strategy’ and similar has been put out to grass and the current incumbents have forgotten about life beyond bricks and tarmac. Maybe that’s harsh, but I do question if any of them have ever spent any time at the coal face of UK agriculture or even own a pair of wellies!

Furthermore, how many of them have ever looked up or read about the past agricultural policies, be it here in the UK or across the world? Do they really have a clue about commodity supply and demand, the impact of weather, how long it takes to grow crops and livestock or understand how amazing the UK agricultural supply chain is compared to others globally?

I really hope the current ignorance is a blip in their education and that they will get a short, sharp wake up call; but it worries me that the UK could honestly become a solar and daisy farm open for Sunday rambles and 100% reliant on imports for almost all our foodstuffs.

Surely, we should learn from others. In a world where many are trying to remove dependence on imports in the light of food security concerns, by improving agricultural productivity, we seem to be on a path of self-destruction with decreasing incentives to do better or invest.

Commodity prices are by their nature set globally and rely on basic supply and demand. The UK has historically been one of the world’s most productive producers of grain by area and over the years has increased its annual domestic demand for commodities – be that through feeding domestic livestock, distilling, milling or ethanol. Good farmers, good commodities and good domestic consumers feeding the nation and others while importing what we physically can’t grow due to climate.

Unfortunately, if we carry on at the current rate of self-destruction, and without a clear plan for the future of farming in the UK, we will be left importing meat, cereals, ethanol and, who knows, maybe even whisky! All the lessons that have been learnt will be undone, our balance of payments will look sick, and we will be heavily reliant on imports, which are likely to be matched only with a huge imported carbon footprint.

Fertiliser matters

As many growers understandably want to ensure autumn planting is completed before investing in additional fertiliser, this has resulted in a slow market for purchasing, particularly across Europe, writes Openfield fertiliser manager, Lucy Hassall.

With the continuation of high energy costs, manufacturers are no longer building stocks during quieter periods until the market is ready.

We are still in a position where production rates are being curtailed resulting in a tightening of supply. This has affected the AN market in particular where both ammonia and European natural gas prices remain firm, meaning we have seen no softening of prices as we sometimes experience during low periods of demand.

Global urea sales appear well covered for the remainder of the year and India has announced another tender for December shipment which could support stable prices.

The market is anticipating a busy start to the new year which means an increase in demand could result in firmer pricing due to tighter supplies should production curtailments continue.

Read more arable news